Portfolio management services for a secure future

The new normal for both businesses and professionals, due to the COVID19 public health emergency, has been a tale of caution and uncertainty. While the industrial output, services’ sector and allied business support mechanisms have felt the tremors of shrinking economic growth and poor returns from the markets. A more sustainable and long-term prospect can still play a key role in changing the ‘doom and gloom’ aspect of how our investment is managed. Portfolio management services or PMS, in this case, offer a tremendous potential to both institutional investors and high net worth individuals – the benefits can be broadly bifurcated into two key areas:

To build and exercise a long-term investment strategy which can sustain ripples and aftershocks of market fluctuations and sentiments.

To cultivate and enter a growth mindset propelled by the expertise of the ‘right people’ behind your investment strategy.

The ability to test, weigh and demonstrate strengths and weaknesses across the full spectrum of investments (and associated services) remains the crucial component of PMS. What differentiates PMS winners is the know-how to spot and weigh opportunities and threats as they manifest and play out in the long term, as per the market ups and downs.

Better start now then later

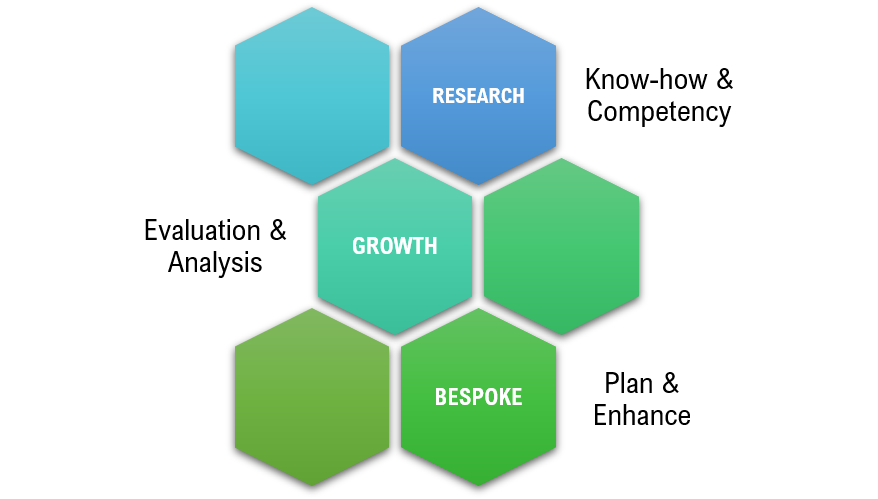

Professional portfolio management services can provide a swift and better turnaround in the current market scenario. Our daily news routine, media scrutiny into investments and industrial outputs may indicate stress on the overall economic health – but, these symptoms in the hands of right professionals can be alleviated. Whether is achieved via active or passive management – portfolio management service partners offer (3) fundamental competencies which even the most astute investor may sometimes miss:

Which would indicate that when the markets and economy do start a wider recovery across all segments – the earliest beneficiaries would be institutions and individuals who chose the right PMS partner.

Key elements that the right PMS partner can bring to the table are:

Build, oversee and to help select investments which meet the long-term financial goals and risk tolerance of an investor.

Better know-how and inputs on asset allocation as well as diversification in short-term financial objective achievement.

As an investor or institution, the key watchpoints which can become benchmarks for you to assess and understand your Portfolio management partner are straightforward (in terms of universal investment understanding). Such objectives include:

Professionals with the right know-how and advanced evaluation experience can uplift your financial vision and even surpass the initial expectations. However, the discretion to manage and allocate resources before choosing the right portfolio management partner should be based on ‘you’ as the investor – asking, simple and objective questions.

Financial situation in the current economic turmoil may take longer recovery times, however, to start now, with the experience and knowledge of professionals can fortify the long-term strategy, in several ways. Take a moment to scrutinise and identify the best-fit of financial know-how traits and knowledge available for you – and move forward towards a more structured and knowledge driven investment strategy.